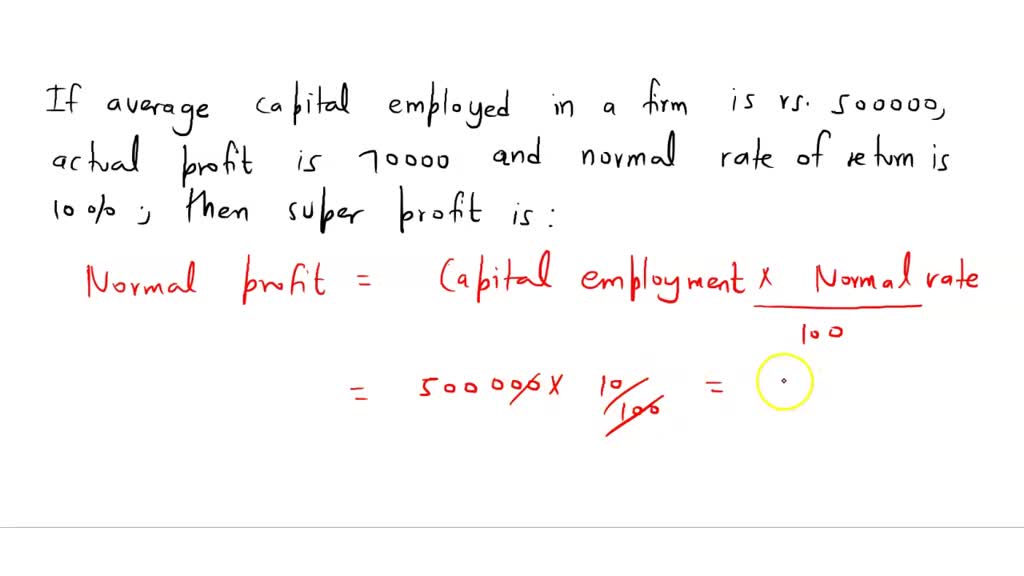

Please and 10th ques Capital Employed x Normal Rate of Return Normal Profit — 100 100 3 Calculation of - Accountancy - Accounting for Partnership Basic Concepts - 12891089 | Meritnation.com

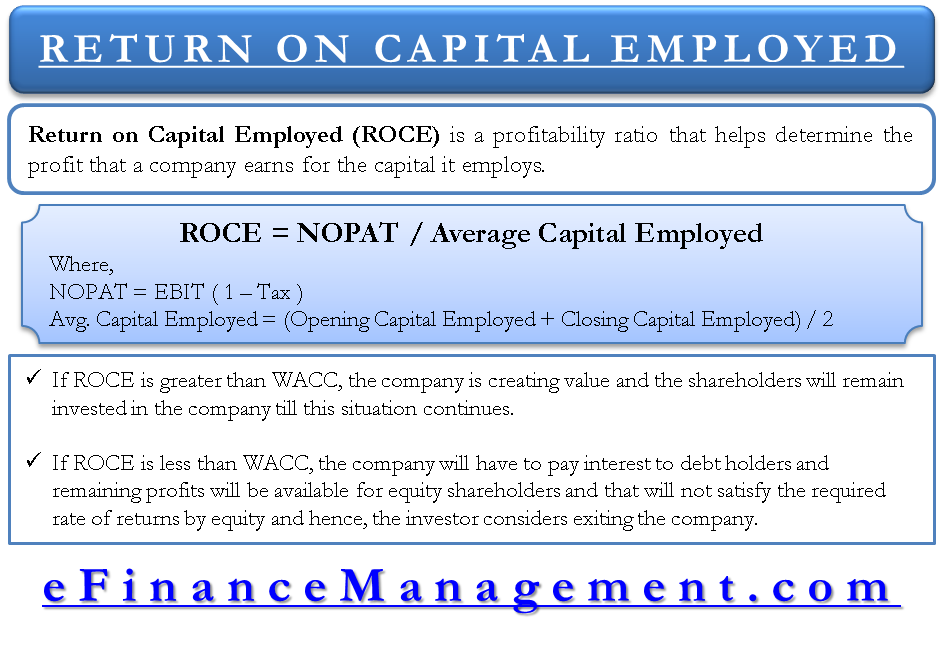

SOLVED: If average capital employed in a firm is rs 500000, actual profit is 70000 and normal rate of return is 10%, calculate super profit.

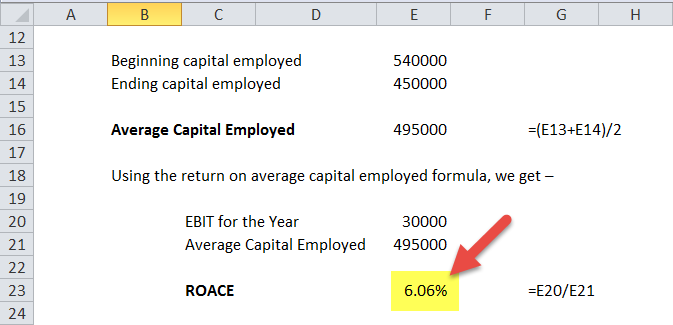

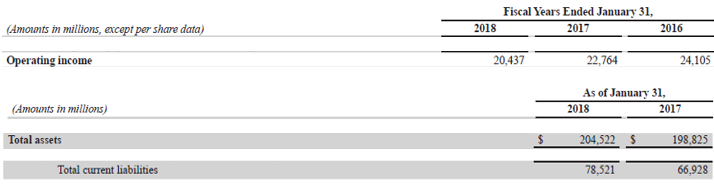

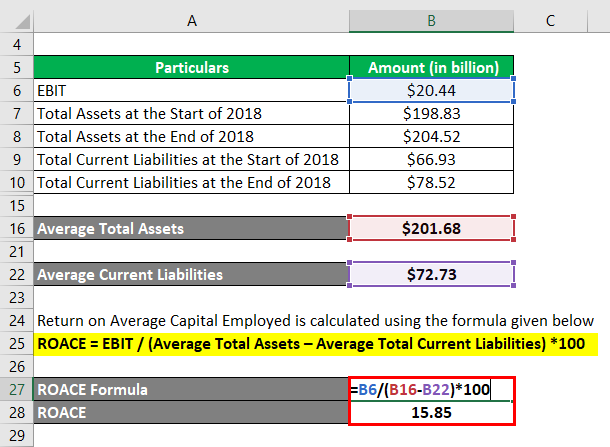

:max_bytes(150000):strip_icc()/return-on-average-capital-employed-roace-final-88868957658840d48f5282029ff8a8f6.png)